[Part of the Social Security Meta-Archive: December 2005]

Social Security Meta-Archive: December 2004

1/1

Confusions about Social Security

Several pages from Krugman writing about Social Security in The Economist's Voice.

David Wessel Does His Social Security Grading

DeLong survey's the Wall Street Journal reporter's grading of the Bush administration and various Democratic players in the SS debate.

1/2

Talking Points Memo

Joshua Micah Marshall on the Bush Administration's hopes to use all of those FICA taxes built up since 1983 to finance tax cuts instead of Social Security.

Social Security Crisis in 2018? Ridiculous

Economist Brad Setser on why it's the Federal "General Fund" that has to pay up in 2018, not Social Security:

Unless the US treasury cannot make good on its promises -- something that truly would change international financial system -- social security does not face a day of reckoning in 2018. When a bond you own comes due, you have the right to redeem it -- or in the case of social security, at least to collect the interest on your bonds (remember that right now social security is both taking in $68 billion more from the payroll tax than it spends on benefits and is lending the $85 billion interest it recieves on its existing holdings of bonds back to the rest of the government ... in total, social security is providing over $153 billion in financing to the rest of the government)1/3

Don't forget that the government -- the non social security part -- has expenditures well in excess of revenues RIGHT NOW. Dick Cheney apparently thinks cash flow deficits that have to be financed by issuing tons of debt don't matter, but cash flow deficits than can be financed by drawing on the interest from your stock of existing assets are a real problem ... interesting financial logic.

An aside: Anyone writing about the social security ought to read both the Trustees and the CBO report. I do have one quibble with the CBO though: its graphics subtly suggest that social security is in much worse shape than it really is. The main graphs focus on payroll taxes v. expenditures, and the graph has been chopped off to magnify the apparent size of the shortfall (the graph starts at 3% of GDP, not 0%). The CBO also buries the key graph showing when the Trust Fund runs out -- i.e. when the gap between payroll taxes and promised benefits can no longer be financed social security's assets. Looking just at the graphs, it is not obvious that the CBO thinks the system is in better shape than the Trustees ...

In 2018, social security won't be able to lend its surplus to the rest of the government, and the rest of the government will have to adjust. That is a problem if you don't like the income tax, because the rest of the government is financed largely by the income tax. Income taxes have to rise, or non-social security spending will have to fall. But so long as the US government is not planning on defaulting, it is not a problem for social security. The payroll tax does not need to increase in 2018, retirement benefits do not need to be cut, there is no problem, let alone a day of reckoning. The Treasury just has to start paying interest on all the bonds social security has bought ...

I think part of the problem the press has is that it seems like the retirement of the baby boom should cause problems for social security. The number of retirees will grow, the numbers of workers per retirees will shrink, and social security benefits will increase from around 4.4% of GDP to about 6% of GDP. How could a constant payroll tax be able to finance the retirement of the baby boom? On the surface, it does not make sense.

The funny thing is that US government was actually responsible in the 1980s, and planned ahead for the impact of the baby boom on social security. The retirement age was increased (a de facto benefit cut), and payroll taxes were raised. Right now the payroll tax takes in more than is needed to pay for current benefits -- revenues are around 5% of GDP and expenditures are around 4.4% of GDP -- and the surplus is lent to the rest of the government. It is a loan, not a grant. The government has to pay it back.

Rather than debating the "problem" created when social security starts to redeem its bonds, we should be debating how to fix our real problem -- the fiscal deficit. Social security now takes in more than it spends. The rest of the government now spends way more than it takes in. On realistic assumptions, it will run a 3.5% of GDP deficit from now til eternity unless something changes -- and even bigger deficits from now til 2014 if you took out the social security surplus.

These ongoing fiscal deficits are the real financial problem facing the US -– not the projected gap after 2042 (or 2055) of 1.5% of GDP or so between payroll taxes and trust fund assets and social security benefits that underlies concern about social security's long-term solvency. I’ll put it differently: unless something changes, the rest of the government will go broke long before social security has any problem paying all its projected benefits.

White House Social Security Memo

By Karl Rove deputy Peter Wehner:

From: Wehner, Peter H. [mailto:Peter_H._Wehner@who.eop.gov]1/4

Sent: Monday, January 03, 2005 2:57 PM

Subject: Some Thoughts on Social Security

I wanted to provide to you our latest thinking (not for attribution) on Social Security reform.

I don't need to tell you that this will be one of the most important conservative undertakings of modern times. If we succeed in reforming Social Security, it will rank as one of the most significant conservative governing achievements ever. The scope and scale of this endeavor are hard to overestimate.

Let me tell you first what our plans are in terms of sequencing and political strategy. We will focus on Social Security immediately in this new year. Our strategy will probably include speeches early this month to establish an important premise: the current system is heading for an iceberg. The notion that younger workers will receive anything like the benefits they have been promised is fiction, unless significant reforms are undertaken. We need to establish in the public mind a key fiscal fact: right now we are on an unsustainable course. That reality needs to be seared into the public consciousness; it is the pre-condition to authentic reform.

Given that, our aim is to introduce market reforms in Social Security and make the system permanently solvent and sustainable.

We intend to pursue the first goal by using our will and energy toward the creation of Personal Retirement Accounts. As you know, our advocacy for personal accounts is tied to our commitment to an Ownership Society -- one in which more people will own their health care plans and have the confidence of owning a piece of their retirement. Our goal is to provide a path to grater opportunity, more freedom, and more control for individuals over their own lives. That is what the personal account debate is fundamentally about -- and it is clearly the crucial new conservative idea in the history of the Social Security debate.

Second, we're going to take a very close look at changing the way benefits are calculated. As you probably know, under current law benefits are calculated by a "wage index" -- but because wages grow faster than inflation, so do Social Security benefits. If we don't address this aspect of the current system, we'll face serious economic risks.

It's worth noting that wage indexation was not part of the original design of Social Security. The current method of wage indexation was created in 1977, under (you guessed it) the Carter Administration. Wage indexation makes it impossible to "grow our way" out of the Social Security problem. If the economy grows faster and wages rise, this produces more tax revenue. But the faster wage growth also means that we owe more in Social Security benefits. This has produced a never-ending cycle of higher tax burdens, even during periods of robust economic growth. It is the classic case of the dog chasing his tail around the tree; he can run faster and faster, and never make any progress.

You may know that there is a small number of conservatives who prefer to push only for investment accounts and make no effort to adjust benefits -- therefore making no effort to address this fundamental structural problem. In my judgment, that's a bad idea. We simply cannot solve the Social Security problem with Personal Retirement Accounts alone. If the goal is permanent solvency and sustainability -- as we believe it should be --then Personal Retirements Accounts, for all their virtues, are insufficient to that task. And playing "kick the can" is simply not the credo of this President. He wants to do what needs to be done for genuine repair of Social Security.

If we duck our duty, it can have serious short-term economic consequences. Here's why. If we borrow $1-2 trillion to cover transition costs for personal savings accounts and make no changes to wage indexing, we will have borrowed trillions and will still confront more than $10 trillion in unfunded liabilities. This could easily cause an economic chain-reaction: the markets go south, interest rates go up, and the economy stalls out. To ignore the structural fiscal issues -- to wholly ignore the matter of the current system's benefit formula -- would be irresponsible.

Here's a startling fact: under current law, an average retiree in 2050 would be scheduled to receive close to 40 percent more (in real terms) in benefits than an average retiree today -- and yet there are no mechanisms in place to produce the revenue to pay out those benefits. No one on this planet can tell you why a 25-year-old person today is entitled to a 40 percent increase in Social Security benefits (in real terms) compared to what a person retiring today receives.

To meet those benefit levels, one option would be to raise the age at which people receive benefits. If we followed the formula used when Social Security was first created -- make the age at which you receive Social Security benefits above the average age of mortality -- we'd be looking at raising the benefit age to around 80. That ain't gonna happen.

Another way to meet those benefit levels is through the traditional Democrat/liberal way: higher taxation. According to the latest report of the Social Security Trustees, the current system's benefit formula would require some $10 trillion in tax increases over the long term. We'd therefore need to raise the payroll tax almost 20 percent simply to provide wage-indexed benefit levels to those born this year.

This will all sound familiar. In the past, the way Congress usually addressed the built-in funding problem was by raising payroll taxes (from 2 percent in 1937 to 12.4 percent today). In fact, Congress has raised Social Security taxes more than 30 times -- but it has never addressed the underlying problem. Avoiding the core issue by raising taxes is not the modus operandi of this President.

The other key point, as you know, is that personal accounts, through the miracle of compound interest, will provide workers with higher retirement benefits than they are currently receiving from Social Security.

At the end of the day, we want to promote both an ownership society and advance the idea of limited government. It seems to me our plan will do so; the plan of some others won't.

Let me add one other important point: we consider our Social Security reform not simply an economic challenge, but a moral goal and a moral good. We have a responsibility to fulfill the promise of Social Security, not undermine it. And we have a duty to ensure that we do not create an inter-generational conflict -- which is precisely what will happen if the Social Security system is not reformed. We need to retain strong ties between the generations, which is of course a deeply conservative belief.

The debate about Social Security is going to be a monumental clash of ideas -- and it's important for the conservative movement that we win both the battle of ideas and the legislation that will give those ideas life. The Democrat Party leadership, the AARP, and many others will go after Social Security reform hammer and tongs. See today's silly New York Times editorial (its only one for the day) as one example. But Democrats and liberals are in a precarious position; they are attempting to block reform to a system that almost every serious-minded person concedes needs it. They are in a position of arguing against modernizing a system created almost four generations ago. Increasingly the Democrat Party is the party of obstruction and opposition. It is the Party of the Past.

For the first time in six decades, the Social Security battle is one we can win -- and in doing so, we can help transform the political and philosophical landscape of the country. We have it within our grasp to move away from dependency on government and toward giving greater power and responsibility to individuals.

There are of course other important issues dealing with Social Security; for now, though, I've covered quite enough ground. I wanted to let you know where things stand. If you have any questions, or if we can send you anything to clarify our plans and respond to critics, just let me know. The President remains flexible on tactics -- and rock-solid on the principles. But there's nothing new there.

In one of his last public acts of an extraordinary public life, the late Democratic Senator from New York, Daniel Patrick Moynihan, co-chaired the President's Commission to Strengthen Social Security. In the introduction of its report, Senator Moynihan (along with Richard Parsons, his co-chair) wrote, "the time to include personal accounts in such action [reforming Social Security] has, indeed, arrived. The details of such accounts are negotiable, but their need is clear.... Carpe diem!"

And so we shall.

Security Flaws

Paul Starr of the American Prospect on the threat to national security presented by owing the cost of Social Security privatization to China.

Stopping the Bum's Rush

Krugman. Did Bush say "imminent"?

The Alternative Social Security Plan Democrats Need To Push As Part Of Their Second Term Agenda

The Diamond-Orszag plan offered as a political option for Democrats by the blog The Left Coaster.

A Tale Of 2 Systems

David Brooks compares America to Europe in facing changing demographics of aging.

High-Fiber Monopoly Diet

Matthew Yglesias responds:

Someone should tell Brooks what the "dependency ratio" actually is. Or that even if we don't change Social Security at all, its cost as a share of GDP will max out at a level far lower than Germany's current rate of public pension outlays. Or that while Europe is aging faster than America, the European model is, in some ways, better-suited to deal with the transition because they have a less costly health care sector. Or that his deployment of the phrase "either way" in paragraph nine indicates that he doesn't understand Edward Prescott's argument at all.

1/5

The Social Security Party Line: Talking Points

Brad DeLong lays down the party line.

1/6

The mask comes off the Social Insecurity plan

Blogger Mark Kleiman of UCLA:

There's a case for worrying that rising OASDI tax rates will become a significant work disincentive, especially if benefit levels are only weakly correlated with taxes paid.The route to real pensions reform

And there's a case for worrying that the existence of Social Security as a relatively generous indexed annunity may be contributing to low household savings rates, and thus both to low national savings rates and to the scandalous maldistribution of wealth that has the typical American dying with not much more than he needs to bury him.

For a description of these problems and a sketch of possible solutions from someone who wants to fix the program rather than wrecking it, see James Tobin's Cowles Commission discussion paper from 1987.)

Now I'm more worried about work disincentives at the bottom of the income distribution, where the current Social Security system acts as an implicit subsidy, than at the top, and I'm far from convinced that private accounts are necessary, or even the best way, to deal with the problems of undersaving and inadequate wealth accumulation.

Still, I acknolwedge that the incentive effects of Social Security are worth worrying about, and that a properly-designed private account scheme might be able to fix them.

A properly-designed system, as my friend David Boyum points out, would have private accounts but not free choice of investment vehicles, and it would be progressive: the annual contribution to the private account would be a fixed sum, not a fixed percentage of earnings. And the payout from those accounts would be in the form of indexed annuities, with individuals having the option to reinvest a portion of what would otherwise be the payout in any given year but not to draw the account down faster than the annuity rate.

And, of course, the transition would be financed with some combination of taxation and spending cuts, not by floating another couple of trillion dollars' worth of bonds; otherwise the change does nothing for the national-savings problem.But then Boyum asks the hard question: given that there exists a private-account system superior to the current system, should Democrats say that they're for it instead of rejecting private accounts altogether? If we had a rhetorically masterful leadership cadre, effective control of the communications channels, and a set of opponents constrained by intellectual honesty, or at least ordinary honesty, in their debating approach, there might be a good case for proposing a serious alternative.

Robert Pozen advocates "progressive indexing" in The Economist.

1/7

The Social Security Debate Once Again

DeLong links to separate Matthew Yglesias discussions of the level of retirement security provision and savings subsidies respectively.

1/9

Select Social Security Biblio

Many links from the blog Explananda.

1/10

Readers Challenge Wisdom of Using TSP as Model for Social Security Accounts

Stephen Barr of the Washington Post.

Why is Re-Indexing So Hard to Understand?

"Adam O'Neill" of the blog The Lowest Deep:

Under the Washington Post's misconception of the re-indexing plan, benefits fall because an individuals earnings are scaled up by the CPI instead of wage growth. But since people's wages grow, er, at the rate of wage growth, a person retiring in 2009 loses about the same fraction of currently promised benefits as someone retiring in 2039 or 2069 or 2099. Instead of everyone getting 42 percent of pre-retirement wages, everyone gets, say, 39 percent.Talking Points Memo

But re-indexing the "bend points" (which were set in 1979) results in cuts that grow geometrically over time. Each year, each new wave of retirees gets a deeper cut than the year before. Look at the CBO's numbers from table 3 (from their analysis of plan 2); every year replacement rates fall further:

(Year of birth, replacement rate)

1940- 42.8

1950- 39.9

1960- 34.8

1970- 30.9

1980- 27.4

1990- 24.6

2000- 21.7

If you keep extending the series, replacement rates continue right on down, asymptotically, towards zero.

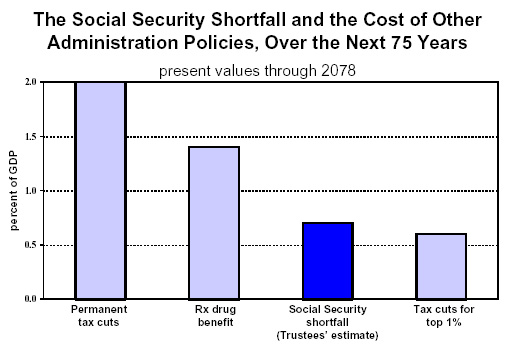

Josh Marshall links to a Center on Budget and Policy Priorities summary demonstrating that Social Security shortfalls are dwarfed by Bush's other fiscal initiatives:

A Bloody Mess

Norma Cohen, in The American Prospect, on the UK experience.

The Iceberg Cometh

Krugman on the SS "Iceberg" and what changing direction does or doesn't do fiscally.

Bush’s Numbers Racket

Dean Baker debunks Bush’s Big Sell.

Risk, Risk, Risk

Jim Geraghty of National Review Online attacks what he sees as the AARP's aversion to risk.

The C-Word: Say It

NRO's Donald Luskin, best-known as the "Stupidest Man Alive" lives up(?) to the rep:

The opponents of reform claim that the Social Security crisis is, in fact, a crisis of general public finance — not one of the Social Security system itself. They see Social Security as an entity separate from the federal government, and maintain that its own dedicated stream of tax revenues and trust-fund assets will keep it going for more than a third of a century.Alas, when it comes to The Stupidest Man Alive, we're all down-bandwidth.

That’s a fair point of view, as far as it goes. At the same time, it is dangerously myopic to treat Social Security in isolation from the overall finances of government. That would be like finding nothing troubling about a factory that dumps pollutants into a river. That may be no problem for the factory itself, but it can be a major problem for everyone downriver. And when it comes to Social Security, we’re all downriver.

It's not Social Security that's "dumping the pollutants." It's the General Fund.

LENINIST-OLIGARCH EXPROPRIATIONIST WATCH

Max Sawicky surveys not-as-stupid-as-Luskin right-wing webbed commentary, focusing on NRO's The Corner.

1/12

Social Security: Crisis? What crisis?

CNN coverage.

1/13

Reforming Social Security

Brookings Briefing with multimedia including William Gale, Peter Orszag, and Robert Pozen.

1/14

The British Evasion

More from Krugman on UK pension schemes.

Social Security and the New Fiscal Policy

Excellent encapsulation of the privatization issue amidst discussion of Bush's profligate fiscal proclivities by Princeton economist Alan Blinder.

“Save Social Security First”?

Byron York says Social Security needs to be saved because Bill Clinton once said so.

1/15

The No. 1 Moral Issue Is--Abortion? No, Social Security

Jonathan Rauch on the moral appeal to conservatism of downsizing the socialization of risk of retirement security.

1/16

A Question of Numbers

Roger Lowenstein's New York Times Magazine article.

1/17

NPR Talk of the Nation: The Future of Social Security

Eugene Steurle, Dean Baker and Stephen Moore guest-star. [Not in THX.]

1/18

Thoughts on Social Security Reform [PDF]

Goldman Sachs analysis.

Stocks' Payoff Myth

Newsweek's Allan Sloan.

U.S. Births, Immigration May Ease Pressures on Social Security

Bloomberg article.

That Magic Moment

Krugman on selling Social Security on the Iraq Model.

Social Security Trust Fund is built on trillion-dollar IOUs

Larry Eichel of the Philadelphia Inquirer.

1/19

Yes, There Is No [Social Security] Crisis, But...

Brad DeLong:

Yes, there is no Social Security crisis. And, yes, whatever Bush proposal makes its way out of the administration must be opposed root and branch--Andrew Samwick and Kent Smetters could design a Social Security privatization scheme that would be an improvement over our present system, but they're not in control.

But there is a long-run Social Security problem--and a reasonable probability that there will be a big long-run Social Security problem--even though it ranks fourth on our list of fiscal problems. And there is a long-run health spending crisis. And there is a short-run deficit crisis. And there is a medium-run where-are-the-resources-to-pay-back-Social-Security crisis.

There is a fiscal crisis--there are lots of fiscal crises, some of them self-generated by the Bush administration. It's just that the fiscal crisis is not a Social Security crisis:

1/20

Newt Gingrich Denies That We Face a Social Security Crisis

Commentary on DeLong's blog in response to Bloomberg coverage.

1/21

The Free Lunch Bunch

Krugman on the politics of privatization.

John Berry Is Not Happy with George W. Bush

Brad DeLong links to a Bloomberg critique of Bush’s Big Sell.

And Paul Krugman Is Not Happy This Morning Either

DeLong mulls over the Bush approach to private accounts.

1/23

ADD TO SAVINGS

Laura D'Andrea Tyson advocates add-on private accounts in a "Social Security Plus" model.

1/25

John Kay Is Shrill!

The Ancient and Hermetic Order of the Shrill links to a Financial Times column on the Bush administration's fiscal brinksmanship when it comes to financing privatization.

Before And After

Angry Bear on Donald Luskin before and after the fact-check.

1/26

David Wessel Talks to the Wise Ned Gramlich About Social Security

Brad DeLong links to a Wall Street Journal interview.

PACK OF LIES

Max Sawicky on Rick Santorum's powerpoint Social Security presentation.

1/27

Social Security Privatization in Chile

DeLong links to a New York Times article.

Pinochet’s private pensions

...While John Quiggen comments at the blog Crooked Timber.

Social Security crisis? Not if wealthy pay their way

Kevin Drum, writing in the Christian Science Monitor, sees the 1983 reform as a grand bargain between the the FICA-tax paying middle class and the income-tax paying wealthy.

Privatizing Social Security: 'Me' Over 'We'

Benjamin R. Barber on approaching SS as a consumer vs. as a citizen.

Take the Plus

Arnold Kling of Tech Central Station is willing to compromise on Gene Sperling's "Social Security Plus."

1/28

Would Social Security Reform Increase Saving?

Richard Berner of Morgan Stanley

Little Black Lies.

Krugman on Bush racial mendacity.

Krugman On Social Security - Off To The Races

Tom Maguire at JustOneMinute responds, triggering extended debate.

Social Security And Distribution

Matthew Yglesias.

1/30

Outlines of a Social Security Deal?

DeLong.

1/31

Big Black Lies

Donald Luskin:

Look up the word “vile” in the dictionary and you will find an appropriate description of Paul Krugman’s New York Times column from last Friday.Let the Looting Begin

The Mises Economics Blog decries compromising with those who actually want to pay for Social Security reform.

Don't use FDR to undermine Social Security

James Roosevelt, Jr.

Social Security Meta-Archive: February 2005

Social Security Meta-Archive: 2005

No comments:

Post a Comment